santa clara county property tax collector

See reviews photos directions phone numbers and more for Santa Clara County Tax. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information.

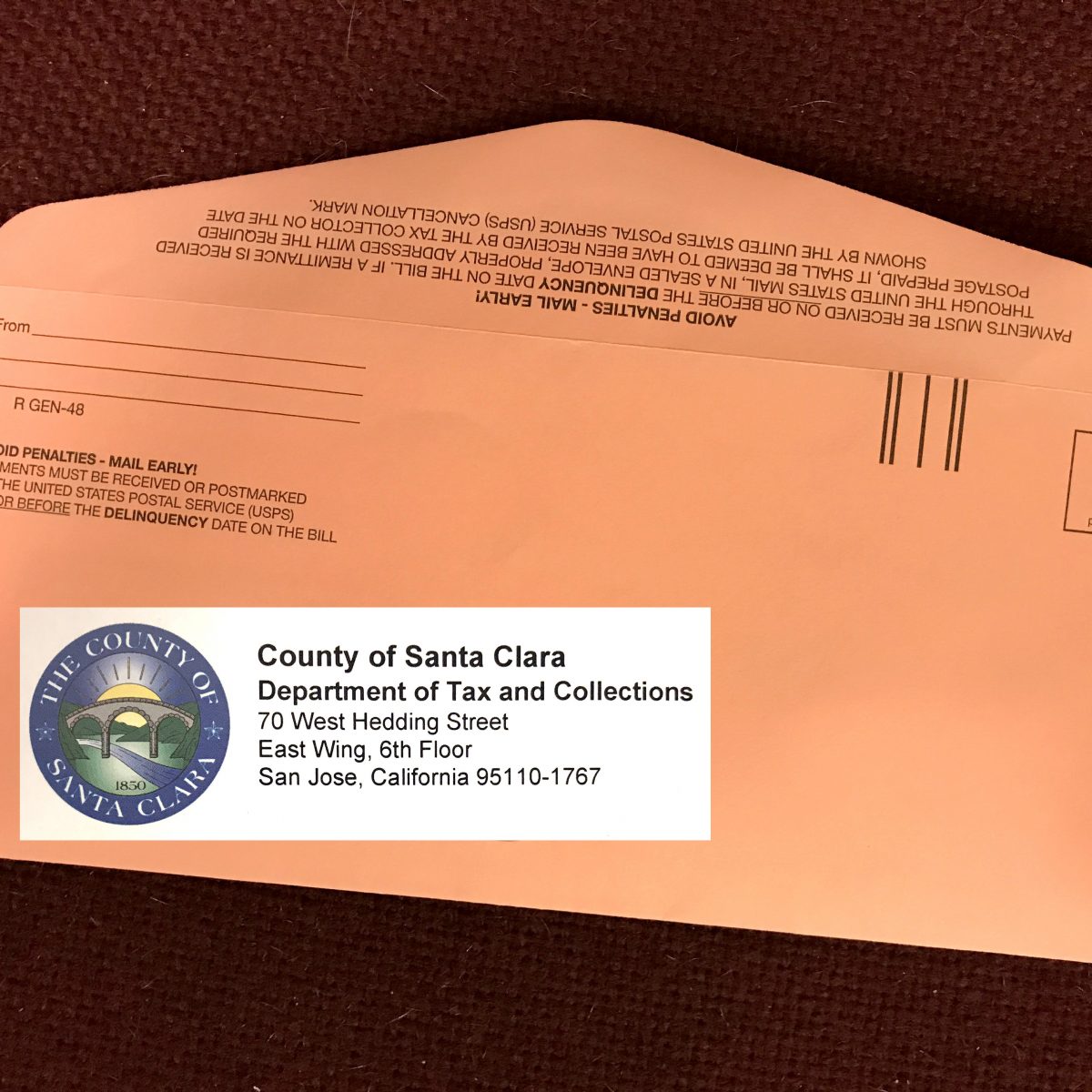

Property Taxes Department Of Tax And Collections County Of Santa Clara

The Controller-Treasurers Property Tax Division allocates and distributes the taxes to the appropriate jurisdictions.

. Payments are processed on the same or next business day. 12345678 Enter Property Address this is not your billing address. Currently the average tax rate is 079.

Click here to register it now. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

Send us a question or make a comment. Save time - e-File your Business Property Statement. Payments made after April 10 will be delinquent and a 10 percent penalty and a.

Currently you may research and print assessment information for individual parcels free of charge. Ad Need Property Records For Properties In Santa Clara County. See reviews photos directions phone numbers and more for Santa Clara County Tax.

00114 of Asessed Home Value. Doing Business As. Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square.

Find Information On Any Santa Clara County Property. Use the dropbox at 70 W Hedding Street or 852 N 1 st Street. 00073 of Asessed Home Value.

See reviews photos directions phone numbers and more for Santa Clara County Tax. Enter Property Parcel Number APN. Finally the Tax Collector prepares property tax bills based on the County Controllers calculations distributes the bills and then collects the.

See reviews photos directions phone numbers and more for Santa Clara County Tax Collector locations in Los Angeles CA. MondayFriday 900 am400 pm. Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square.

MondayFriday 800 am 500 pm. The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. 12345678 Enter Account Number.

Last Day to file Business Property Statement without 10 Penalty. Closed on County Holidays. Last Payment accepted at 445 pm Phone Hours.

The Santa Clara County Office of the Tax Collector reminds the public that the deadline for the second installment of 20162017 property taxes will be Monday April 10 2017 by 500 pm. 1 2022 - May 9 2022. The general tax levy is determined in accordance with State Law and is limited to 1 assessed value of your property.

Some property andor parts thereof may be subject to a special exemptionsuch as those for veterans or non-profit organizations like churches or hospitals. 00076 of Asessed Home Value. Doing Business As.

Enter Property Address this is not your billing address. Business Property Statement Filing Period. Due Date for filing Business Property Statement.

Check the website to track your payment at. After applying tax rates the County Controller calculates the total tax amount. Click here to contact us.

Effective tax rate Santa Clara County.

Santa Clara County Ca Property Tax Search And Records Propertyshark

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara Shannon Snyder Cpas

Property Taxes Department Of Tax And Collections County Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

When Is A Building Permit Required County Of Santa Clara

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Open Competitive Job Opportunities Sorted By Job Title Ascending County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County California Fha Va And Usda Loan Information

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Taxes Department Of Tax And Collections County Of Santa Clara